Property Inspector: What do the different house price reports mean?

United Kingdom- Important to be aware of differences between indices

- Average price for 2 bed home in England now £157,788, according to TheMoveChannel.com

- London most expensive market in UK, with average 2 bed house price of £495,543

- Live property price information available on TheMoveChannel.com’s new Map Search

Property Inspector: Are there too many UK property portals?

United KingdomTheMoveChannel.com´s Property Inspector. Taking a closer look at global real estate each month.

- Growing number of UK portals reflects UK housing market recovery

- UK listings up 50% y-o-y on TheMoveChannel.com

- “Hard to shake” the dominance of Rightmove and Zoopla

- New portals “have to do something different”

- Enquiries on TheMoveChannel.com up 23% y-o-y

The UK housing market is on the up. It´s no secret. Sales, lending and prices are all rising. The biggest sign that UK real estate is recovering, though, is the industry´s response: new property portals and estate agents are popping up all over the internet, from the announcement of easyProperty to even Poundland´s founder starting EstatesDirect.com.

At the top are Rightmove and Zoopla, enjoying rising traffic levels. As new agent-backed portals launch to combat the dominance of the big sites, TheMoveChannel.com´s podcast discusses the state of the UK property portal industry.

Are there too many portals? Will it ever be possible to end the dominance of the big websites?

We interview Ian Spencer, Marketing Manager of real estate lead generation specialists Lead Galaxy.

Click here to listen to the full investigation. An abridged transcript follows:

House prices are up. But is the biggest sign of the UK housing recovery the number of new portals and estate agents?

Yes. I think it´s important to remember these portals don´t appear overnight. Months of planning and swarovski sets discount development have gone into them – people noticed the recovery last year and started work, knowing that a year later they´d be even stronger. Certainly, the UK economy is going to be reflected by what happens in terms of online property portals.

Confidence among homeowners looking to sell is improving too. There is certainly a market for places to advertise…

A lot of sellers have held off. If you go back two years, you wouldn´t really have been thinking about selling your house. TheMoveChannel.com on its own has seen a 50% increase in UK property listings in the last year. It follows the trend of the economy and what´s happening out there – that´s only going to be reflected by the number of sites coming online helping people to sell.

Is it possible to have too many property portals?

You can have too many anything! That´s where the internet has shone through – if you had too many people doing the cheap Oakley sunglasses, Oakley goggles,Oakley ski goggles same thing on the high street, they would go out of business. Online, it´s unlimited.

With so many portals focussing on the UK, SEO competition for the first page of Google is bound to be high, isn´t it?

It´s going to be interesting to see how that pans out. You have to look at the top three at the moment – Zoopla, Rightmove and Prime Location – which dominate a phenomenal amount of the traffic and listings within Google. But if you´ve got the money, you can compete. That´s for sure.

Zoopla and Rightmove have both seen traffic climb in 2013. How dominant are they?

You have to bear in mind that even though they´re online, they have a massive offline campaign too. You see them on TV, in the majority of the estate agents they work with. Without the high street, there wouldn´t be that many listings on Rightmove.

Several agent-backed portals, such as Property Mutual and Agents´ Mutual, are launching with the aim of tackling what they perceive to be unfair market dominance. How easy is it to do that?

In terms of organic traffic, it´s going to be hard to shake what´s there at the moment. The ones that are launching in the coming months, we don´t know what they´re doing. Is there going to be a wealth of content? Are they going to do something new? New portals have to do something different, going back to our previous podcast about SEO. TheMoveChannel.com, for example, ranks well, but we´re 15 years old and we have a lot of different kinds of listings compared to other portals.

Agents´ Mutual has a rule that clients can only advertise on one other portal, which some have speculated will only increase the dominance of market-leading sites…

With about 1,000 listings that´s quite controllable but when they get to five or six million, how would you stop someone going elsewhere?

Look at it like this: if you had a magazine charging you a lot of money to get in front of a lot of people and another magazine charging you less to get in front of fewer people, which do you choose? Maybe some people feel aggrieved, but you pay to get results.

Will we ever see the death of high street estate agents?

Without the high street, there´s no Rightmove and there´s no Zoopla, if we´re being honest. The majority of the listings on those portals are from estate agents with a presence on the high street. There are some reports that say online estate agents will provide 60 per cent of those listings in a couple of years, but these are theories and guesses. I never see the end of the high street because there are always people who want to go in and talk to someone in person, especially for selling.

With so many portals and agents, is it better to focus on a niche sector or location?

There are two aspects. If you go for something niche, you´re going to have fewer people looking, so you might not get the figures you´re looking for but it might be easier to get in front of them.

The other option, like TheMoveChannel.com, is to be more comprehensive. Does that work?

Comprehensive, but well thought out and planned! Now, compared to this time last year, our enquiries are up 23 per cent, so having a wide range has worked. It goes back to the planning phase, changing to what your user wants. If you do that, you can go for a lot of things under one umbrella, but you´ve got to give people an easy way to find them, otherwise they´ll go somewhere else.

Does the future look bright for the property portal industry? Will there be more portals to come?Yes. And as competition comes along, new ideas come along and the audience grows. So if you´re looking to sell a house it´s going to get a bigger audience, and if you´re looking for a house, it´s going to be easier to find one.

Notes to Editors

Founded in 1999, TheMoveChannel.com is the leading independent website for international property, with more than 800,000 listings in over 100 countries around the world, marketed on behalf of agents, developers and private owners.

The website address ishttp://www.TheMoveChannel.com and the office address is 24 Jack’s Place, Corbet Place, Spitalfields, London, E1 6NN.

Contact Dan Johnson on 0207 952 7650 for further information.

At a Glance: Demand soars for property across Portugal

PortugalDemand has soared for property across Portugal, according to new research from TheMoveChannel.com. The portal´s latest infographic compares Portugal´s property market now to two years ago and reveals that enquiries have surged by one-third on a national level, as interest returns outside of the Algarve.

Lisbon is now the most-searched property hotspot in Portugal, according to TheMoveChannel.com, accounting for 4.33 per cent of all Portugal searches on the site in the 12 months to February 2014, up from 3.61 per cent in the 12 months to February 2012. The Portuguese capital knocked Albufeira off the top search spot. The Faro town was the subject of 9.63 per cent searches in 2012´s At a Glance report, but its share has now dropped to 3.26 per cent, as buyers begin to look all over Portugal for real estate investments.

Indeed, the Algarve accounts for five of the 10 most searched-for Portuguese locations on TheMoveChannel.com, down from six two years ago. Leiria and Lisbon made up the remaining four locations in 2012, but Lisbon now makes up three of the remaining five, alongside Setubal and Braga – an indicator of how varied and widespread interest has become.

The Algarve still receives the majority (60 per cent) of enquiries, but its share has fallen from 62.59 per cent in 2012. Leiria also saw its number of enquiries dip 44 per cent and Viana do Castelo saw enquiries slide 20 per cent. Apart from these three, though, every district in Portugal saw enquiries increase in 2014 compared to 2012.

Lisbon led the way with a rise of 55 per cent in enquiries, taking its share to the third highest in the country. The district of Madeira has the second highest share of enquiries, attracting 12.49 per cent, up from third place.

Overall, enquiries for Portuguese real estate have soared 33 per cent across the last two years.

The At a Glance infographic also analyses the number of searches on Google for property in Portugal. Demand there has surged too. 39,000 searches for “property in Portugal” were logged between March and May 2013, 10 times the 3,600 recorded across the same period in 2011.

Portugal-related keywords that previously appeared in no Google searches also began to be used by online house-hunters. “Portuguese properties”, for example, was not searched for at all between March and May 2011 but appeared in 60 searches between March and May 2013.

Google searches for “property in Portugal” slowed to 3,780 between December 2013 and February 2014, but even with the seasonal decline in interest remained significantly higher than the same three months two years ago.

Editor Ivan Radford comments: “What a difference two years makes! In 2011, Portugal´s property market was hanging on by the Algarve. The Faro region was driving the majority of interest and activity, with Portugal´s lifestyle appeal continuing to attract bargain holiday home hunters.

“Now, though, Portugal´s property market is coming back to life. The 2012 At a Glance infographic showed activity centred on the Faro district, but the updated 2014 infographic sees activity spread out evenly across the whole map.

“Alongside lifestyle buyers, encouraged by growing economic confidence in Europe, the rise in interest has been driven by investors taking advantage of the country´s Golden Visa residency scheme. For these buyers, cities such as Lisbon are a priority rather than the coastal towns of the Algarve. The surge in demand for property in the capital may not have ended the dominance of the Algarve, but shows how much the national market has improved in 24 months, with all but three districts enjoying a rise in enquiries.

“Growth is present at all stages of the buying process: initial interest on Google has increased, engaged buyers searching by location on TheMoveChannel.com have also risen, and that interest has converted into more enquiries. After years of struggling, 2014 looks to be a good year for Portugal´s property market.”

Click here to see the full infographic.

Notes to Editors

Founded in 1999, TheMoveChannel.com is the leading independent website for international property, with more than 800,000 listings in over 100 countries around the world, marketed on behalf of agents, developers and private owners.

The website address is http://www.TheMoveChannel.com and the office address is 24 Jack’s Place, Corbet Place, Spitalfields, London, E1 6NN. Contact Dan Johnson on 0207 952 7650 for further information.

Investment Watch: Student property investment goes global

United KingdomStudent property investment went global in February 2014, according to new research from TheMoveChannel.com. The property portal´s Investment Watch report reveals that student housing continues to dominate activity on the site, with buyers now turning to opportunities in the USA as well as UK.

Student property in Florida received the highest number of enquiries on TheMoveChannel.com in February 2014, the first time this has ever happened. The tenanted condos in Tallahassee are located five minutes away from two universities and start from $48,900, offering guaranteed rental returns of 8.5 per cent, enough to attract over twice as many enquiries as a student property listing in the UK.

Bolton´s The Cube development has been a subject of consistent interest from buyers, appearing in two of the past three months´ top 10 most popular listings. The units, priced at £39,950 and advertising NET yields of 10 per cent, offer a combination of low cost and high returns that is typical of the student housing sector.

The second most popular investment in February featured buy-to-let apartments in Manchester. The luxury three-bedroom flats in the city´s Trafford Mill development cost £115,000 for cash buyers, with 8 per cent NET annual rental returns assured for one year. Confidence in the UK´s recovering real estate also saw buyers turn to Wales, where a £25,000 hotel room assured 10 per cent returns for 10 years.

Investors were willing to look outside of the UK for income, though, with a hotel room in Picardie receiving the third highest number of enquiries. This is the second time in five months that the discounted French resort has appeared in TheMoveChannel.com´s top 10 listings, a sign that investors are heading back to France thanks to attractive prices as well as accessible financing.

The Bahamas remains popular among buyers too, with January´s number one listing – a building plot on Long Island – sliding to sixth place in February. Demand for alternative investments is also strong, driven by two oil investments in the bottom half of the Investment Watch top 10. Both are priced below £7,000, an indicator of continued buyer interest in low cost opportunities.

The student housing sector remains the most popular overall, providing the affordability of alternative products but with the reliability of real estate investment. A Bradford project (seventh place) offers 10 per cent returns for £55,000 and another UK student development (ninth place) promises 10 cent returns for £44,950, taking the total number of student property listings in the top 10 to four.

Florida´s student condos generated the biggest response, though. With the US property market recovering over the past 12 months, the demand for investing in student property at a much cheaper cost proves that the sector´s strength is not just limited to the UK.

Director Dan Johnson comments: “Student property continues to be the most widely sought-after asset on TheMoveChannel.com. Investors are increasingly concentrated on affordable opportunities, such as alternative products, that can deliver strong returns. The student property sector combines that affordability with reliability unmatched by other assets – it is no surprise that, according to CBRE, investment in UK student housing totalled more than £2 billion in 2013 for the second year in a row!

“While the UK property market is booming, though, demand for accommodation at universities is universal. In America, where house prices are more affordable and the economic recovery is boosting confidence, the sector is even more attractive. This is the first time a student property in Florida has been listed on TheMoveChannel.com. The overwhelming response shows that investors are not afraid to go back to school, no matter where that school might be.”

Click here to see the 10 most popular property listings in February 2014.

Notes to Editors

Founded in 1999, TheMoveChannel.com is the leading independent website for international property, with more than 800,000 listings in over 100 countries around the world, marketed on behalf of agents, developers and private owners.

The website address is http://www.TheMoveChannel.com and the office address is 24 Jack’s Place, Corbet Place, Spitalfields, London, E1 6NN.

Contact Dan Johnson on 0207 952 7650 for further information.

At a Glance: Indian investors have their eye on Hyderabad

United KingdomInvestors in Indian property have their eye on Hyderabad, reveals research by TheMoveChannel.com. The capital of Andhra Pradesh will become the capital of India´s new state, Telangana, this summer, and 10 per cent of buyers are already searching for opportunities.

- Mumbai attracts almost 1/4 of searches for Indian property

- Hyderabad accounts for 1 in 10 searches by location

- Maharashtra generates most property enquiries

- Tamil Nadu second most popular state

The At a Glance infographic, which is based on activity on the property portal in the last 12 months, reveals that Mumbai is the driving force of India´s real estate, attracting almost one quarter (22.6 per cent) of searches for property by location. Pune was the second most sought-after place, targeted by 12 per cent of searches, ahead of Hyderabad, which was the subject of 10.4 per cent of searches.

The three are far ahead of the country´s other major cities, with Chennai, Bangalore and Delhi receiving just 4 per cent, 3.1 per cent and 2.8 per cent of enquiries respectively. Together, Pune, Mumbai and Hyderabad account for 45 per cent of location-based search activity.

Mumbai is the most popular property destination when it comes to enquiries too. The state of Maharashtra, which is also home to Pune, accounted for 35 per cent of enquiries in the year to February 2014. Tamil Nadu is the second most popular state of India for property buyers, generating 14.57 per cent of enquiries, ahead of Kerala and Assam, which received 8.78 per cent and 8.13 per cent respectively.

Andhra Pradesh, of which Hyderabad is the capital, accounted for 6.26 per cent of activity, making it the fifth most popular state for property.

The infographic also charts search activity on Google relating to Indian property. Buyers tended to search in general for “property in India” and “India property”, while “houses for sale” were the most popular property type, ahead of land, hotels, apartments and villas. Searches in general for Indian property declined over the last 12 months, although interest rallied in the final quarter of 2013.

TheMoveChannel.com Editor Ivan Radford comments:

“It may come as no surprise that Mumbai is the most dominant property market in the country, but TheMoveChannel.com´s infographic capture´s India´s real estate at a fascinating time: just on the verge of creating a new state, Telangana. The new state will be made up of 10 districts from Andhra Pradesh, which will transform the country´s property market, as well as investment from both home and overseas.

“The approval of the new state has resolved some political uncertainty in the country, which is expected to boost confidence among investors. Indeed, buyer activity in Andhra Pradesh is already on the up: enquiries for property in the state have increased significantly in the last six months on TheMoveChannel.com.

“The capital Hyderabad has been highlighted by many as an investment hotspot thanks to the city´s affordable real estate and impending role as capital of two states: both Telangana and Seema Andhra (what will be left of Andhra Pradesh following the split). Once the new state has been formed, it will be interesting to see what happens to the country´s property market. As interest in the area heats up, though, it is clear that Hyderabad is already catching the eye of buyers.”

Click here to view the full infographic.

Notes to Editors

Founded in 1999, TheMoveChannel.com is the leading independent website for international property, with more than 800,000 listings in over 100 countries around the world, marketed on behalf of agents, developers and private owners.

The website address is http://www.themovechannel.com and the office address is 24 Jack´s Place, Corbet Place, Spitalfields, London, E1 6NN.

Contact Dan Johnson on 0207 952 7650 for further information.

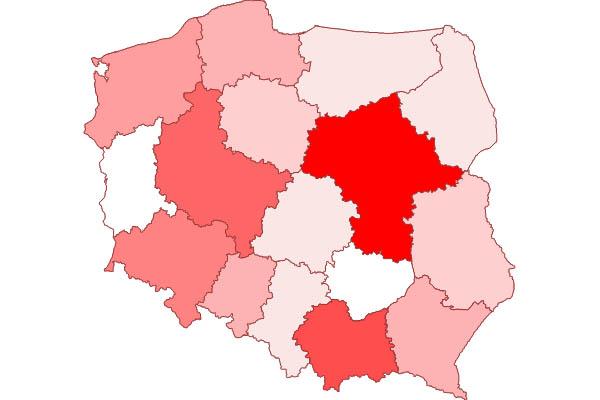

At a Glance: Warsaw tops Polish property wish list

WorldWarsaw is top of buyers´ Polish property wish list,TheMoveChannel.com´s latest research reveals. The portal´s At a Glance infographic shows that real estate in Poland is a tale of three cities, but that activity is driven by the capital, which accounts for almost one-quarter of all buyers´ searches.

22.4 per cent of searches in the 12 months to January 2014 were directed towards Warsaw, making the capital city the second most sought-after location in the country. Krakow was the most looked-for property market, attracting 23.3 per cent of searches. While interest in the two was almost equal, though, that activity translated into twice as many enquiries in Warsaw´s district of Masovia.

Masovia, home to two of the 10 most popular cities (Warsaw and Konstancin-jeziorna), accounted for 37.7 per cent of all Polish real estate enquiries in the past year, far ahead of Malopolskie, which accounted for another two of the top 10 (Krakow and Zakopane) and 18.8 per cent of enquires. Together, the two districts are responsible for four of the most in-demand cities in Poland and make up 56.5 per cent of the country´s enquiries on TheMoveChannel.com.

The third most popular region was Wielkopolskie, responsible for the top 10´s Poznan and Lodz, as well as 17.4 per cent of enquiries. Dolnoslkaskie was the fourth most popular district, generating 9.6 per cent of enquiries. It is home to Wroclaw, the third most searched-for city on the site. All the other districts accounted for fewer than 5 per cent of enquiries.

The infographic also analyses activity on Google from the past year related to buying property in Poland. “Property in Poland” was the most commonly used phrase. “Houses for sale in Poland” are the most popular type of real estate; there were no searches for “villas for sale in Poland” on Google in the past year.

Searches featuring the general keywords “property for sale in Poland” have decreased in the past year, particularly during the winter months at the end of 2013. While interest in Polish property appears to be diminishing, though, demand for land appears to be growing. Indeed, the number of searches for “land in Poland” almost doubled in the 12 months to January 2014, with 140 searches recorded in the three months between February and April 2013 rising to 230 in past three months.

TheMoveChannel.com Editor Ivan Radford comments: “When laid out on paper, Poland´s property market is a tale of three cities: Krakow is top of the shopping list thanks to its historical and cultural appeal; Wroclaw´s beautiful riverside scenery and Gothic architecture attracts more than one in 10 searches; but Warsaw, a centre of both nightlife and commerce, appeals to investors and buyers, to the extent that the district of Masovia generated more than double the enquiries of Molopolskie, home to Krakow, in the last year.

“Poland´s economy has been strong in recent years. GDP grew 1.7 per cent in the third quarter of 2013 compared to the same period in 2012, according to Eurostat. That stability appears to have helped fuel a rise in interest in the country´s property on TheMoveChannel.com since November 2013. It is interesting to note that away from our portal, interest is also climbing in the country´s land opportunities.”

Notes to Editors

Cheap wedding dresses are one of the most noticeable things in a wedding. Which dress should you wear; its style and fitting need your attention. Different countries have different fashion statements for dress designs. So choosing your perfect dress is really a difficult task.

Founded in 1999, TheMoveChannel.com is the leading independent website for international property, with more than 800,000 listings in over 100 countries around the world, marketed on behalf of agents, developers and private owners.

The website address is http://www.themovechannel.com and the office address is 24 Jack´s Place, Corbet Place, Spitalfields, London, E1 6NN.

Contact Dan Johnson on 0207 952 7650 for further information.

Property Inspector: Generation rent: Madrid vs. London

Spain United KingdomThe state of the UK buy-to-let market is no secret: even as Help to Buy helps people climb the property ladder, tenant demand stays strong. But how does Britain´s rental sector compare to Spain? TheMoveChannel.com´s podcast compares the experiences of a Madrid renter to a London letter.

- Buy-to-let booms in Britain

- Spanish housing crisis good news for tenants?

- 9.1 per cent of Madrid rents reduced in October 2013

- Rents in London up 4.9 per cent year-on-year in October 2013

TheMoveChannel.com´s Property Inspector: taking a closer look at global real estate each month.

The housing crisis has left a lot of UK house hunters stuck as tenants, with landlords able to snap up the houses that are available and charge high rates. For Spanish renters, though, the housing crisis may have been a good thing, judging by the Property Inspector´s chat with Silvia Platero Peña, as large supply and low prices appear to produce favourable conditions for tenants.

Indeed, according to idealista.com, 6.3 per cent of all homes listed for rent in Spain reduced their rates in October 2013, 11.5 per cent higher than the previous month. In Madrid, 9.1 per cent of rental prices were reduced.

In London, meanwhile, rents jumped 4.9 per cent year-on-year in London, according to LSL Property Services, while the number of new tenancies also increased – that demand has helped to push up rents throughout 2013. Help to Buy is helping to slow down that demand and stabilise rents, according to other indexes, but the broad conditions remain the same.

In terms of investment, another idealista.com report shows that the gross return on a rental property in Madrid was 4.2 per cent in the second quarter of 2013. In London, rising property prices have offset rental incomes, leaving the UK capital outside of HSBC´s top 10 buy-to-let hotspots in April 2013. Even so, the highest yields available in the UK capital were 6.15 per cent in the borough of Southwark, much higher than Spain´s capital.

The head of research at idealista.com, Fernando Encinar, says the discounted rental rates “clearly shows that property owners are aware that price remains the determining factor in closing a deal”.

Are Spain´s landlords more sympathetic to growing numbers of cash-strapped tenants amid high levels of unemployment?

Silvia´s friend recently moved flat in Madrid. Steve recently moved flat in London. We record a conversation between them discussing their experiences of renting property.

Click here to listen to the full discussion.

How hard was it to find a place to rent?

Silvia: It was easy for her. She wanted to move but she didn’t spend much time looking – finally, she found it by chance!

Steve: It was quite tough, mainly because there were so many people looking at the same time. Our specific budget, below £1,000 per month, is also pretty rare in London, which made it tougher.

Are there many homes/flats available on the market?

Silvia: Yes, there are many flats available on the market.

Steve: It depends on location and price. I think the main problem is competition for the supply that there is, with a lot of people renting because they can´t buy.

Are there lots of people fighting over the same rental property?

Silvia: People don’t fight over the same home, because there are many places to live.

Steve: Yes, competition is high. If we viewed a home one day, it could be gone by the time we made an offer.

Did you have to be quick to sign a contract before someone else moved in?

Silvia: No

Steve: Yes. To secure the flat, we made an offer on the spot while at the viewing and also paid a deposit to reserve it.

Was your landlord willing to negotiate on how much you pay?

Silvia: Yes, he let me negotiate but not too much.

Steve: Yes, he was willing to negotiate, although not by a huge amount.

Are rents more expensive now, in your opinion?

Silvia: No, the cost of renting rooms has dropped €100.

Steve: Yes, I think so. Our landlord is now trying to increase our rent when we renew the contract next month to keep in line with rising prices around the area.

Was it harder to move flat now than when she last moved?

Silvia: No, now it is easier because prices are cheaper and there are more houses available because of the crisis.

Have you ever considered moving to another city or country?

Steve: No.

Silvia: Yes, she would like to move to any country, she doesn’t care where.

Notes to Editors

Founded in 1999, TheMoveChannel.com is the leading independent website for international property, with more than 800,000 listings in over 100 countries around the world.

The website address is http://www.themovechannel.com and the office address is 24 Jack´s Place, Corbet Place, Spitalfields, London, E1 6NN.

Contact Dan Johnson on 0207 952 7650 for further information.

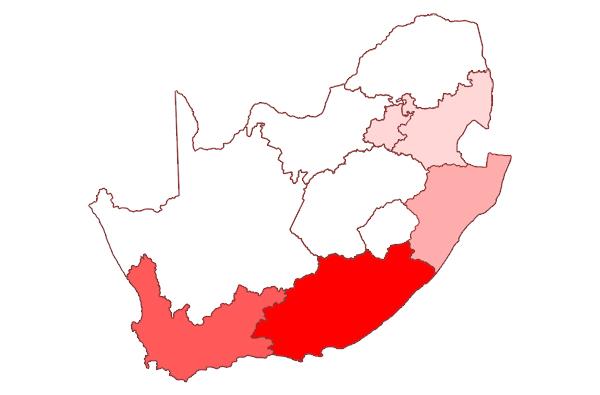

At a Glance: Eastern Cape drives demand for South African property

World- Eastern Cape accounts for 74.1% of South African enquiries

- Johannesburg most sought-after location, accounting for 1 in 10 searches

- Buyer demand highest for coastal areas