- Regional Christmas markets pulling in shoppers from far and wide

- Arras French Christmas market drawing shoppers across the Channel

- Twinkling festive lights and beach sunsets a winning combination in Spain

Each year, towns and cities around the world hang up their twinkly lights and roll out the market stalls, ready for the magic of Christmas to come alive once more. From traditional toys to quirky gifts, Christmas markets provide a wonderfully atmospheric way to do your Christmas shopping, with plenty of tasty treats thrown in to keep you going.

According to the Nabma ROI team, Christmas markets generate more than £250 million in visitor spending. Deloitte, meanwhile, are projecting a rise of 1% in our Christmas spending this year, with an average spend of £567 per person over the festive season. The figure is 42% higher than the European average. The majority of the expenditure (£299) will be on gifts, though food and drink and socialising will account for a fair amount, at £151 and £66 respectively.

Those shopping for properties at this time of year can enjoy the delights of local Christmas markets as they analyse the area(s) they’re interested in. Here, we’ve rounded up some of the best festive markets and the best local properties, to give them a head start.

Birmingham

Birmingham is known for hosting the largest German Christmas market outside of Germany or Austria. From craft beers and artisan edibles to toys and crafts, this is a great place to do your Christmas shopping while indulging in some incredible gingerbread.

In terms of property market opportunities, Birmingham is home to the exceptional Westminster Works. Nestled in the city’s hip and happening Digbeth area, the 220 elegant apartments are available from £168,000 through Surrenden Invest.

Manchester

Manchester’s Christmas market attracts millions of visitors each year, with a wide variety of gifts, toys and gourmet treats, alongside an ice rink to burn off all those extra Christmas calories.

For property investors, Ancoats Gardens is the obvious choice. The latest of Surrenden Invest’s investment opportunities, the world-class apartments are one of the city’s most exciting developments. Prices start from £229,714.

France

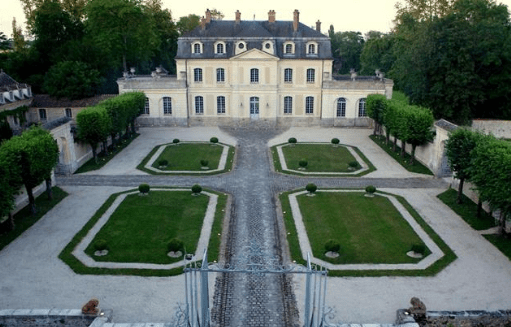

Of course, it’s not just the UK that has jumped on the Christmas market trend. Shoppers looking to head across the Channel will find one of France’s most beautiful Christmas markets just an hour’s drive from Calais. The market is set in the midst of the splendid, Flemish-style architecture of Arras, some of which is UNESCO World Heritage listed. The Village de Noël includes more than 130 chalets, surrounded by richly decorated Christmas trees and fairy lights. Toys, gifts and gourmet treats abound, along with an action-packed funfair with everything from an ice rink and toboggan slide to a merry-go-round and big wheel.

Properties in the local area are as diverse as the gifts for sale at the market. One of the most interesting currently on the market is a three-storey water mill with beautiful grounds, which spans the River Ternoise. Ripe for conversion, the property is on the market for €309,000.

Spain

A short plane ride away, Spain also hosts some superb Christmas markets each year. In the Costa del Sol, visitors can enjoy sunshine and beachscapes during the day, then head for the gently twinkling lights of the Nordic-style stalls in Estepona of an evening. Traditional teddy bears, clothing, craft items, festive Spanish treats and much more await eager shoppers, while an ice rink and children’s playground ensure little ones (and not so little ones) will be entertained too.

On the property front, Taylor Wimpey España’s picturesque Green Golf development is home to 48 spacious houses with large terraces and spectacular golf course views. Prices for these three-bedroom, three-bathroom home start from €280,000 plus VAT, with residents enjoying lush communal gardens and pools as part of their purchase.

For more information:

Surrenden Invest: visit www.surrendeninvest.com or call 0203 3726 499

FrenchEntrée: visit www.frenchentree.com/property-for-sale/ or call +44 (0)1225 463752.

Taylor Wimpey España: visit www.taylorwimpeyspain.com or call 08000 121 020 (or 00 34 971 706 972 from outside the UK).