- Healthy development pipeline and strong demand from domestic and international students to be defining factors for PBSA success in 2017 (Knight Frank)

- Cormorant House, Huddersfield is the perfect starter investment for those looking to introduce themselves to PBSA market (Aspen Woolf)

- Cormorant House will provide 168 PBSA apartments all with high end hotel apartment style finishes (Aspen Woolf)

As the UK’s student population continues to grow, so too does the demand for appropriate housing in university towns and cities across the country. And welcoming an increasing number of students is causing many places to expand their student accommodation offering, allowing Purpose Built Student Accommodation (PBSA) to take centre stage.

Rachel Pengilley, partner in the Knight Frank student property team, is confident in the future prospects of PBSA, explaining that “as we look to 2017, rental growth, strong demand from domestic and international students and a healthy development pipeline are set to be the defining factors in the sector’s success.”

Now home to four major educational institutions; the University of Huddersfield, Kirklees College, Greenhead College and Huddersfield New College, Huddersfield is now very much in demand with both domestic and international students. With over 48,000 students from more than 120 countries currently studying in the West Yorkshire town, 2017 will see a growing need for appropriate accommodation.

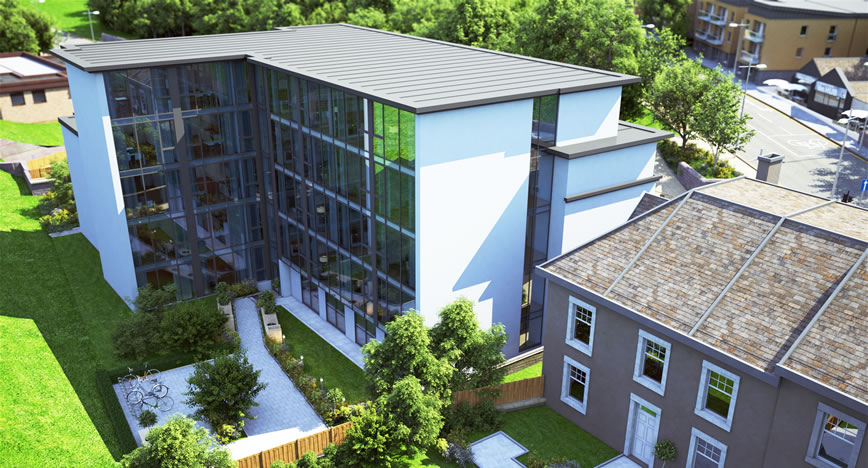

Leading investment agency, Aspen Woolf’s latest offering in the PBSA market is located for just this reason in Huddersfield. Cormorant House is situated within a key redevelopment area of the town, less than 150m from Kirklees College and under half a mile from the University of Huddersfield making it an excellent choice for potential student tenants.

Fellow Yorkshireman and Director of Aspen Woolf, Oliver Ramsden, believes Huddersfield is the ideal place for first time or ‘fresher’ investors to start a PBSA portfolio. He explains,

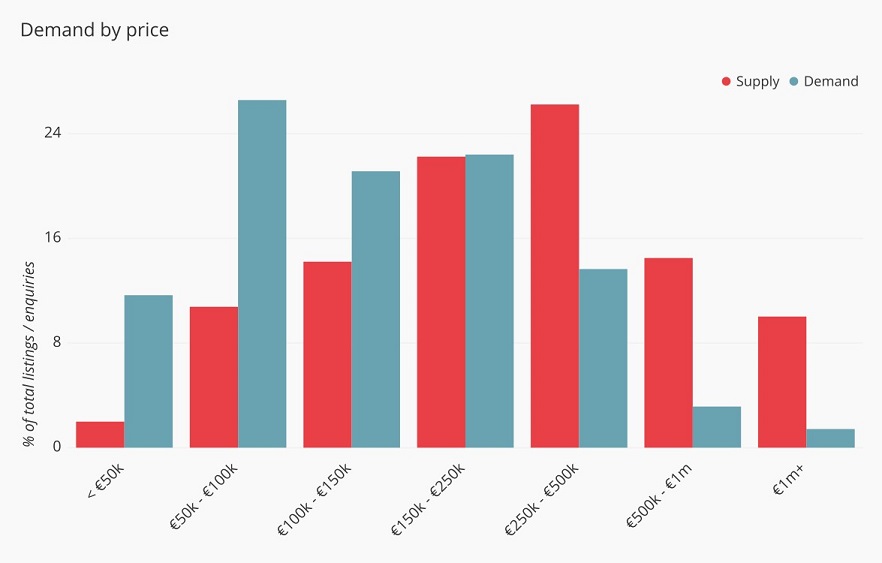

“Cormorant House is the perfect starter investment for those looking to introduce themselves to the PBSA market. Currently there is a significant imbalance between the demand for PBSA in Huddersfield and the available units for rent. And as student numbers moving to the town continues to grow, so too will this imbalance with breaking point not too far away.

“With a comparatively low entry price, we see Huddersfield as a lower risk investment, expecting the area to blossom over the course of the next few years.”

Self-contained studio apartments start at just £57,995, giving investors an assured 5-year NET rental of 9%. With the first phase already well under construction and nearing completion, Cormorant House will provide a total of 168 purpose built modern student apartments for the Huddersfield student housing market. Every apartment will be offered fully furnished to prospective student tenants and the building will benefit from modern, high-end hotel apartment style finishes.

Set to be the premier student accommodation in Huddersfield, its residents will also benefit from an excellent range of on-site amenities including a games and television room, private cinema, study rooms and an impressive I.T. suite as well as onsite laundry facilities and parking.

For more information, visit www.aspenwoolf.co.uk or contact Aspen Woolf on +44 203 176 0060.