- Tulips, hyacinths and long, elegant stems are spot on for spring

- Large leaves and plentiful foliage are the latest essentials

- Consider high-end silk blooms for lasting beauty

As March brings the first hints of spring sunshine, buds are swelling on branches all around. The turning of the seasons means that it’s time for the use of florals within the home – as well as without – to come into focus once more.

Florist Lisa Caulton is part of the team of outstanding interior designers at Alexander James Interior Design. With spring approaching, she shares her secrets on using flowers to maximum effect and the most inspiring 2017 floral trends.

How long have you worked for Alexander James Interiors?

I have been working for AJI for 4 years now, and absolutely love it. It is great working with such a great team and alongside such talented designers.

What is your background as a florist?

I have worked in floristry for the past 20 years, designing and creating displays for corporate events, hotels and designing weddings. I’ve also worked in local florists. Working with silk flowers has allowed me to be much more creative, with floral designs creating life-like displays in beautiful luxurious properties.

How does the process work in terms of creating floral arrangements for a project?

Our designers come to me with their mood boards and images of the property. Flowers are then selected based on interior style and colour scheme. For some projects I go and create the floral displays on site, especially if it is a big project. Flowers are used in every room, with the quantity of flowers depending on a client’s budget.

All flowers used are silk faux flowers, as real flowers would perish in our show home projects. The silk faux flowers we use are very high quality, so they are still very realistic and deliver the same great effect.

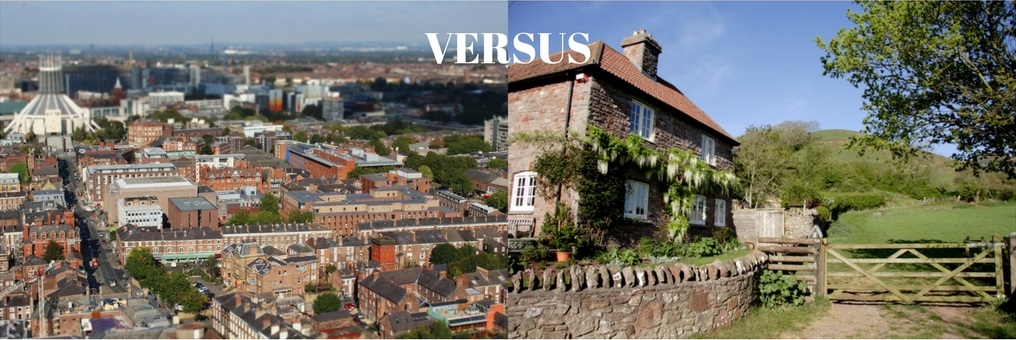

Flower arrangements are made to co-ordinate with the style of interior. We cover everything from rustic and country style to eclectic and contemporary.

What are your favourite flowers?

My favourite flowers are tulips, and my favourite plants are succulents, both of which are spring-like and currently on trend. I often go to flower shows to keep up with current trends and have attended shows in Paris and Holland. I often find inspiration for my work at these shows.

Do you incorporate your personal taste into your work?

No, it is important to always follow the current trends of flowers and plants in interiors. It is also important to think ahead to the next season due to our lead times. It is important to remain unbiased, using only the brief and mood boards to coordinate the flower arrangements for a project.

What has been your favourite project to date?

I really enjoy large projects, where I need to create arrangements to the scale of the property. Recent projects such as The Chapel at Mill Hill and Windlesham’s Woodrow mansion have been amazing to work on, as I have been able to create such large arrangements and stunning centrepieces.

What is your favourite interior design style?

My favourite interior style is eclectic, such as the style used in quirky London apartments.

What are the latest trends in floral design?

Trends often depend on interior style. For example, in a rustic property, stone pots, lavender baskets and flower jugs are perfect.

Current trends are very plant-orientated, with lots of foliage and big leaves. Trends often move with the seasons: spring projects will feature spring flowers such as hyacinths, tulips and the prettier, more elegant flowers.

For more information, visit Alexander James Interior Design at www.aji.co.uk, email info@aji.co.uk or call 020 7887 7604.