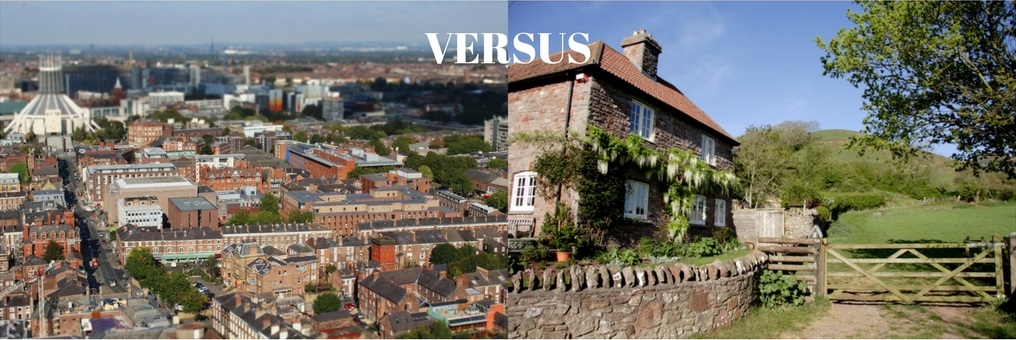

Town vs country – the investment dilemma

- Risk-averse investors drawn to city centre buy-to-let developments (Aspen Woolf)

- Interior design giving landlords the edge (Alexander James Interior Design)

- Strong returns tempting investors to newer asset classes in the countryside (Properties of the World)

There’s an age-old debate about whether city living trumps country living, or vice versa.

UN figures show that our world is gradually becoming more urban, with 54% of the global population currently residing in urban areas. The figure is projected to rise to 66% by 2050, emphasising the pull of the city on those seeking economic opportunities and a wealth of cultural and entertainment options.

Just as city and country living appeal differently to different folks, so too do the prospects of investing in such diverse locations.

“Investors looking for city centre properties tend to be those who are keen for long-term returns with lower risk. They’re seeking an established asset class – buy-to-let – which has been around long enough to be proven as a model that generates consistent yields. The solidity of the asset class is paramount, even over and above considerations like the tax relief reductions for landlords, which the government is phasing in from 2017 onwards.”

Oliver Ramsden, Founder and Director, Aspen Woolf

As well as buy-to-let investors looking for brand new developments, cities tend to attract those investors who want to take an active role in their property investment. Buying a house and refurbishing it can result in capital gains as well as healthy rental yields and many investors enjoy the buzz of managing their own properties. It can be a competitive occupation, and those at the forefront of the industry are continually seeking new ways to ensure that their properties stand out from the crowd. Engaging professional interior design consultants is the hottest new trend.

“We are working with a growing number of individuals who never imagined they would be employing interior designers to create a beautiful interior for their home. Interior design used to be the preserve of the very wealthy. Now, there’s a growing trend for people at every level of the property ladder to use expert services of this nature.”

Robert Walker, Managing Director, Alexander James Interior Design

Those investors who favour properties in the countryside tend to have a different focus than their city investor counterparts. They’re prepared to take on newer and more innovative asset classes in the pursuit of higher returns and lower taxes.

“Hotel investment can generate excellent yields, and buyers are free from the concerns of Stamp Duty Land Tax and the hit to income that void periods can cause. Strong returns and fewer taxes to worry about is an attractive combination. Many countryside investments also come with a personal usage element, meaning that investors essentially get two weeks of free holiday accommodation thrown into the deal each year.”

Jean Liggett, CEO, Properties of the World

The restrictions on tax relief for residential landlords has the potential to mark a step-change in investor preferences. From 2017 to 2018, only 75% of finance costs will be deductible from rental income. The figure will reduce annually, until it reaches 0% for the 2020 to 2021 financial year.

As city centre buy-to-let developments become gradually less profitable for all those other than cash buyers, will former city investors head for the hills? Only time will tell.

On the market:

The perfect city investment: Set on the edge of the vibrant Liverpool city centre, the New Eldon Grove offers the perfect balance of past and present comprised of 45 apartments including 1,2 and 3 bedroom units. Carefully designed to preserve the heritage of the site while serving the needs of a new generation, from just £94,950, New Eldon Grove provides investors with an assured 2-year NET rental of 7%. Available through Aspen Woolf.

Escape to the country: In the Valleys of South Wales, lodges and land plots at Afan Valley Adventure Resort allow investors to be part of a thrilling new adventure experience. Lodges are priced from £149,000 and offer 8% NET returns for seven years, with two weeks’ personal usage. Land plots offer a mark-up of 10% per annum for three years, from just £25,000. Both available through Properties of the World.

For more information, please contact:

Aspen Woolf: +44 203 176 0060 or www.aspenwoolf.co.uk

Alexander James Interior Design: 020 7887 7604 or www.aji.co.uk

Properties of the World: +44 (0)20 7624 5555 or www.propertiesoftheworld.co.uk