- The best locations for spending your money in 2017

- Buy a second home in Spain, invest in a hotel in North Wales and holiday in Tenerife

- Stick with the UK for buy-to-let investment and play the stock market from the comfort of your bed

With one eye on the future and one on the hottest property and location trends of 2016, it’s time to look at the best places to spend your money in 2017. The 2017 Where To… list covers everything from holidays and holiday homes, to property investments and playing the stock market.

Where To… Buy a second home

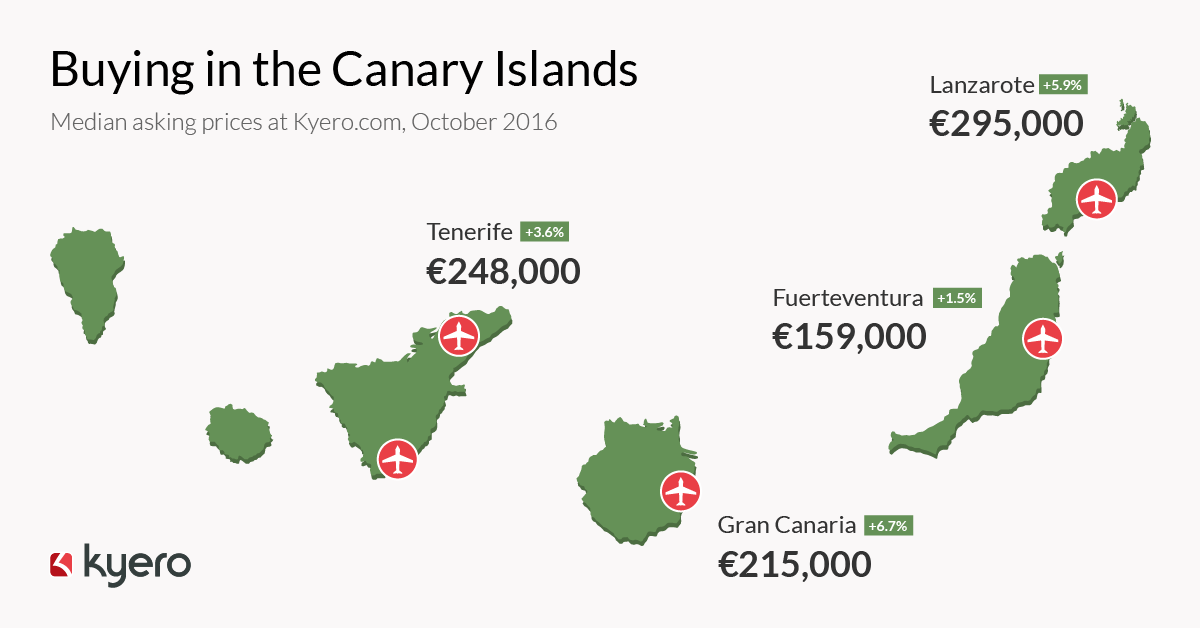

When it comes to buying a second home, Spain is the obvious choice for many. Post-Brexit vote reports are that property sales and enquiries from British buyers have ramped up noticeably. Leading Spanish property portal Kyero.com has reported record enquiry numbers since the referendum. Head of Research Richard Speigal comments,

“Spain offers a great climate, fabulous food and excellent value for money. Brexit doesn’t seem to have deterred British buyers in the slightest. In fact, it seems to have spurred many on to purchase their dream second home sooner rather than later.”

The golf courses and beaches of the Costa del Sol are ideal for those looking for a second home in Spain. Taylor Wimpey España is offering spacious apartments and townhouses at Horizon Golf near Mijas from €270,000+VAT.

Where To… Invest in a hotel

An up-and-coming asset class, hotel investment looks set to take off in a big way in the UK over the next couple of years. Jean Liggett, pioneering CEO of Properties of the World, comments,

“Hotel investment offers excellent returns and benefits from not being subject to stamp duty. It’s ideal for property investors who are looking to get more for their money.”

Those investing in Caer Rhun Hall Hotel in Conwy, North Wales (rooms available from £75,000), can look forward to returns of circa 10% per annum, 125% developer optional buy-back and two weeks’ personal usage of their hotel room per year.

Where to…Holiday over the winter months

When it comes to winter sunshine, Tenerife is one of the top short-haul destinations for those travelling from the UK. Idyllic beaches with a sea temperature of 21°C and an average December temperature of 17°C, combined with excellent value for money make this an enticing destination. There’s plenty on offer to entertain the whole family all year round, and some outstanding value hotel rooms available over the winter months.

Cheap Holidays Tenerife has rooms available from as little as £93 per night for those looking to stock up on vitamin D before Christmas and from just £98 per night for holidaymakers planning a break in the New Year.

Where To… Invest in a buy-to-let property

Despite the increase to stamp duty on second homes earlier this year, the UK’s buy-to-let market is still faring well. There are plenty of cities around the UK that offer great returns and the potential for capital growth. One of the most exciting for 2017 is Belfast.

Property prices in Northern Ireland remain some 40% below their 2007 peak, but they’re rising fast. Buy-to-let investors with an eye on capital gains as well as healthy yields are examining the market there closely. With Belfast accounting for 43% of Northern Ireland’s total rental transactions, it is the natural choice for those looking to invest in buy-to-let.

The Frontiers’ Collection at The Sandford, located in Belfast’s thriving Titanic Quarter and available through Property Frontiers, offers one bedroom apartments from £114,750 and two bedroom homes from £141,750.

Over in England it is Manchester that is turning heads as a buy-to-let destination. Surrenden Invest is supporting would-be landlords to avoid paying the proposed ‘Green Tax’ by offering the low-carbon technology Artillery House for investment. The contemporary development enjoys a prime city centre location in Manchester’s ‘Golden Triangle’ and will be one of the city’s most energy efficient buildings. The 12 high end, boutique apartments are available for investment from £120,000.

Where To… Play the stock market

If stocks and shares appeal more than bricks and mortar, 2017 could be the perfect time to try out your skills as a trader. easyMarkets is on a mission to democratise trading, making it possible for anyone with an interest in the markets to dabble from the comfort of their own home. Not only do they offer learning resources and regular insights for those who are new to trading, but their innovative dealCancellation product means that losing trades can be cancelled within 60 minutes of making them – perfect for nervous newbies!

For more information, please contact:

Kyero: www.kyero.com

Taylor Wimpey España: 08000 121 020 (00 34 971 706 972 from outside of the UK) or www.taylorwimpeyspain.com

Properties of the World: +44 20 7624 5555 or www.propertiesoftheworld.co.uk

Cheap Holidays Tenerife: 0800 0124 300 or www.cheap-holidays-tenerife.com

Property Frontiers: +44 1865 202 700 or www.propertyfrontiers.com

easyMarkets: +44 203 1500 748 or www.easymarkets.com